Doug Casey's Top Prediction for 2025: A Cultural and Economic Sea Change

- johnwick

- Jan 2, 2025

- 4 min read

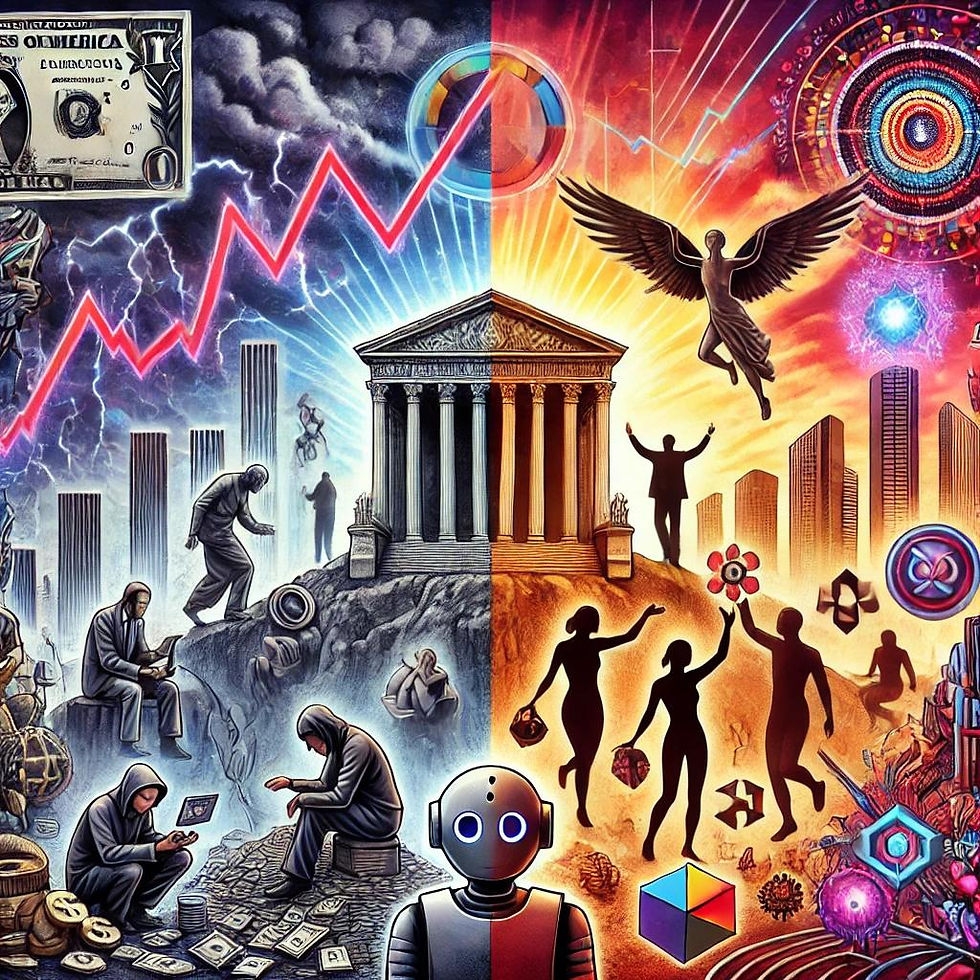

The world is on the cusp of significant transformations in 2025, according to renowned investor and philosopher Doug Casey. His insights on finance, economics, politics, and culture point toward a year of accelerated change—some of it surprising and even paradoxical. Here are the major trends and events Casey believes we should prepare for, many of which remain overlooked by the mainstream.

The Cultural Shift: A Retreat of Wokeism

Casey observes that 2024 marked the beginning of a cultural counterrevolution, and this trend will accelerate in 2025. Progressivism, wokeism, and associated ideologies like DEI (Diversity, Equity, Inclusion) and ESG (Environmental, Social, Governance) are losing their grip. White males, often the targets of these ideologies, are increasingly rejecting labels like "racist" or "sexist" and standing firm against being canceled.

Conservative and libertarian movements are gaining traction globally. In Germany, the AfD party is poised to oust the current government, echoing the libertarian revolution led by Javier Milei in Argentina. In Canada, the Trudeau government—referred to here as "Castro’s son"—is facing a likely downfall. The media, once complicit in promoting progressive narratives, is beginning to acknowledge these cultural shifts.

While globalists like those at the World Economic Forum (WEF) still cling to their 2030 agendas, the tides are turning against their goals. Casey argues that this cultural change is not just a rejection of progressivism but a broader reawakening of values centered around individual freedom and self-reliance.

Economic Forecast: The Greater Depression and Beyond

Despite this cultural optimism, Casey warns that we remain on the brink of a severe financial crisis. The fundamentals of the global economy are shaky, with high levels of debt, distorted markets, and excessive government intervention. The possibility of a bird flu pandemic in 2025—used as a pretext for further government overreach—adds another layer of uncertainty.

Casey foresees two possible scenarios:

Best Case: A reallocation of capital away from consumption and toward rebuilding wealth. This could lead to a drop in living standards in the short term but ultimately foster an economic boom driven by technological advancements.

Worst Case: A continuation of reckless borrowing and spending, resulting in a hyperinflationary depression.

The middle class, which Casey identifies as the engine of production and vitality in any society, will play a pivotal role in determining which scenario unfolds. He warns that the parasitic elements of society—those who take more from the system than they contribute—must be curtailed for meaningful progress to occur.

The Role of Technology: A Double-Edged Sword

While politics and economics dominate the headlines, Casey highlights the transformative power of technology as the most significant force shaping the future. Innovations in AI, quantum computing, and nanotechnology are advancing at an exponential rate, leading us closer to what futurist Ray Kurzweil calls the Singularity. By the end of the decade, humanoid robots could become commonplace, fundamentally altering the nature of work and life.

However, these advancements come with risks. The same technologies that can create abundance could also lead to unprecedented surveillance and control if misused by governments or corporations.

Trump’s Return: Geopolitical Implications

The return of Donald Trump to the White House brings both opportunities and challenges. On one hand, deregulation and a focus on efficiency could boost economic productivity and lower costs, masking some effects of inflation. On the other hand, continued military spending and the weaponization of the US dollar could exacerbate tensions with countries like China.

Casey also notes that the US government’s fiscal trajectory is unsustainable. With over 800 military bases abroad and a ballooning debt, America’s role as a global hegemon is under threat. The geopolitical landscape in 2025 will likely feature a more fragmented and multipolar world order.

Investment Outlook: Opportunities Amid Turmoil

For investors, Casey’s advice remains consistent: focus on tangible assets and sectors that benefit from deregulation. He sees tremendous potential in companies owning mineral deposits, predicting that this sector will see explosive growth as the global economy reorients itself. Conversely, he views the general stock and bond markets as high-risk areas, overvalued and prone to significant corrections.

But financial assets are only part of the equation. Casey emphasizes the importance of personal development: “Your main asset isn’t things. It’s your knowledge, your skills, and your character.” In a rapidly changing world, adaptability, continuous learning, and ethical behavior will be critical for survival and success.

Preparing for 2025 and Beyond

The year 2025 promises to be one of rapid and unpredictable change, marked by cultural renewal, economic challenges, and technological breakthroughs. While the road ahead may be turbulent, those who are prepared—both financially and personally—will find opportunities amid the chaos.

At Income from Gold, we believe that tangible assets like gold are an essential part of any resilient portfolio. In uncertain times, gold provides a hedge against inflation, currency devaluation, and market volatility. As Doug Casey’s insights make clear, the coming year will reward those who are proactive, informed, and prepared for the unexpected.

If you’re ready to safeguard your wealth and capitalize on the opportunities 2025 will bring, explore our resources and services at www.incomefromgold.com.

Comments