A Century of Gold Price History (1900-Present)

- johnwick

- Oct 28, 2024

- 4 min read

Gold has held a prominent place in human history, valued for its rarity, beauty, and as a measure of wealth. The price of gold has evolved significantly over the last century, shaped by global events, economic policies, and shifts in market demand. Exploring gold’s price history since 1900 reveals a dynamic journey that continues to impact investors today.

Early 20th Century: Gold Standard and Fixed Prices

In the early 1900s, many countries operated under the gold standard, where the currency was directly tied to a set amount of gold. This arrangement kept the price of gold stable; for example, in the U.S., the price was fixed at $20.67 per ounce. Under the gold standard, the value of money was largely dependent on gold reserves, which allowed for minimal fluctuation in its price.

However, the economic impact of the Great Depression in the 1930s led to major policy changes. In 1933, President Franklin D. Roosevelt raised the official price of gold to $35 per ounce, devaluing the dollar to spur economic recovery. This policy shift significantly increased the U.S. government's gold holdings and marked the beginning of gold's rise as an increasingly strategic asset.

Post-World War II and the Bretton Woods System

After World War II, the Bretton Woods Agreement established a new international monetary system where the U.S. dollar was tied to gold, while other currencies were pegged to the dollar. This agreement fixed the price of gold at $35 per ounce, creating stability but also building pressure on gold reserves as global economies grew. Eventually, demand for gold exceeded U.S. supply, leading to concerns about the sustainability of this system.

By 1971, President Richard Nixon announced the end of direct gold convertibility, effectively dissolving the Bretton Woods system and allowing gold prices to float freely for the first time. This policy shift launched the modern era of gold as a freely traded commodity, subject to supply and demand dynamics.

The 1970s: Inflation and Unprecedented Price Surges

The 1970s were a turbulent time for gold prices. With inflation on the rise and political uncertainty due to the oil crisis and geopolitical conflicts, gold prices surged as investors sought a hedge against economic instability. By 1980, gold reached a record high of $850 per ounce—a tenfold increase in less than a decade—as inflation peaked and investors looked to gold for security.

1980s-2000: A Period of Stabilization and Decline

Following the 1980 peak, gold prices began a steady decline through the 1980s and 1990s, as inflation cooled and global economies entered a period of relative stability. Gold traded between $300 and $400 per ounce for most of this period, with fluctuations due to occasional geopolitical tensions but overall lower demand as economic stability returned.

The late 1990s saw central banks around the world reducing their gold holdings, which put further downward pressure on prices. Gold, however, remained an essential part of national reserves, valued for its historical role and potential as a safe-haven asset.

The 21st Century: Financial Crises and Record Highs

The 2000s brought renewed attention to gold, particularly with the onset of the 2008 financial crisis. As markets crashed and currencies devalued, investors flocked to gold as a hedge against economic uncertainty. Gold prices reached an all-time high of around $1,900 per ounce in 2011, fueled by fears of inflation and currency devaluation. This period underscored gold's role as a safe-haven asset, especially in times of financial instability.

The 2020 COVID-19 pandemic once again highlighted gold's appeal, with prices reaching new highs of over $2,075 per ounce. Concerns about economic recovery, central bank policies, and inflation made gold an attractive investment as the world grappled with unprecedented challenges.

Key Drivers of Gold Price Movements Over Time

Economic Crises and Inflation: Gold has consistently proven its value as a hedge against inflation. Periods of high inflation, such as the 1970s and post-2008, have driven up gold prices.

Geopolitical Events: Wars, political instability, and global crises create uncertainty, often leading to increased demand for gold. This was evident in periods like World War II, the oil crisis, and recent global health crises.

Currency Value and Central Bank Policy: The end of the gold standard and the floating of currencies made gold prices more sensitive to changes in the dollar’s value and interest rates. When the dollar weakens, gold typically becomes more attractive.

Supply and Demand Dynamics: Gold mining and production costs, alongside fluctuating consumer demand for jewelry and technology, can impact prices. Limited supply and increased demand for investment purposes create significant price changes.

What a Century of Gold Price History Means for Investors

A century of gold price history illustrates its resilience and importance as a long-term investment. Gold’s ability to retain value across economic cycles makes it a trusted asset in times of uncertainty. Whether as a hedge against inflation, a safeguard during crises, or a reserve asset, gold continues to play a vital role in diversified portfolios, helping investors preserve wealth across generations.

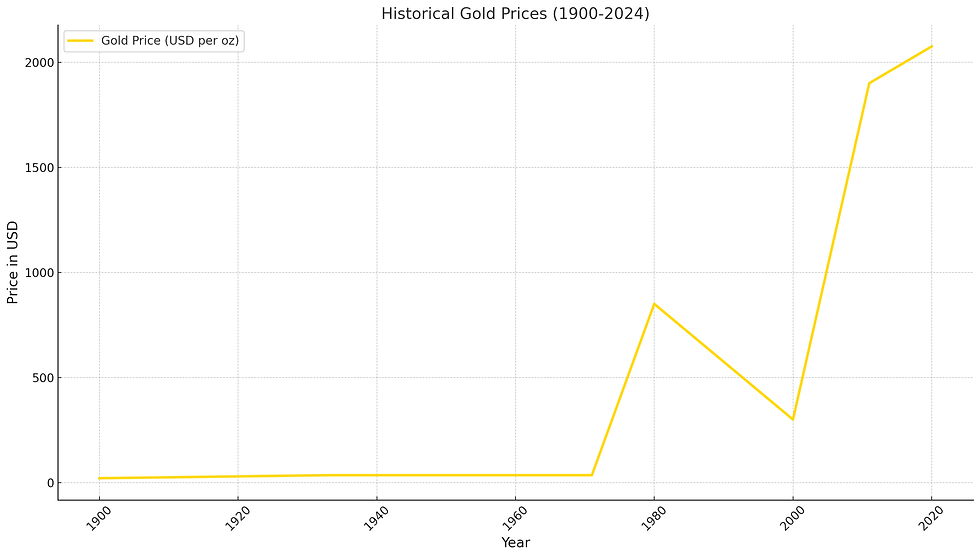

Gold Price Chart

Below is a historical chart showing the journey of gold prices from 1900 to the present, highlighting significant economic periods and price shifts.

Historical Gold Prices (1900 - 2024)

Here is the historical gold price chart spanning from 1900 to 2024, showcasing key price shifts at significant economic and political moments. This chart provides a clear view of gold's value progression over the last century.

Comments